City finances can be quite confusing at first, but we can simplify them – both by explaining how they work and by constructing a budget that separates expenses into easily understandable chunks. NOTE: We’ll discuss revenues in detail in this post and look at expenses in separate posts.

We have two major categories of revenue and expense. One interesting fact that many people don’t realize is that tax money goes to the general funds and utility money goes to Enterprise funds. That means, for example, that spending money on streets, parks, library, or police doesn’t change your cost of electricity.

- General Fund – This includes areas like Parks, Streets, Library, Police, Animal Control, and City Beautification. NOTE: This is the fund we’ll discuss in this post.

- Enterprise Fund – These are city business funds for the enterprises in the city that specifically generate revenue outside of taxes. Our two primary funds that fall into Enterprise are Utilities and Airport. NOTE: We will discuss this fund in a separate post.

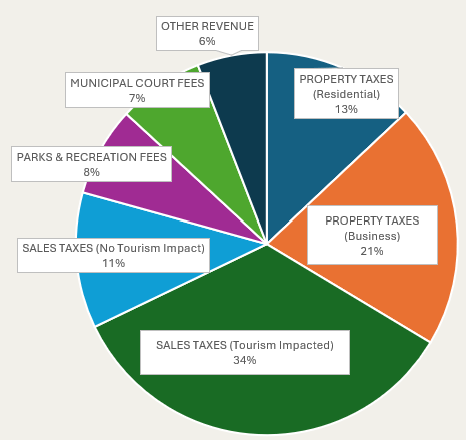

General Fund Revenue Sources

The numbers stated below are from the audited numbers from Fiscal Year 2021, but the percentages remain fairly close year to year.

Our two greatest sources of income are: Property Tax (34%) and Sales Tax (45%) – combined, they make up roughly 80% of all General Fund Revenue.

Another great way to look at this is that our businesses contribute over 66% of the total revenue to the city’s General Fund. Rooftops (homes inside city limits) only contribute 13%.

One connection that many people don’t make is that the better the businesses do the more money that comes into the city to help improve our streets, parks, library and other services.

Sales Tax Revenue Sources

The Sales Tax was detailed into two separate categories. The No Tourism Impact are the sales tax from goods and services purchased that are directly attributable to residents and businesses inside city limits. The Tourism Impacted are sales tax that can be increased by people of the broader community – things like restaurants, retail shops, auto services, and other hospitality items.

Property Tax Revenue Sources

Some people are quite surprised when they learn that Residential Property Tax Rates only make up 13% of the General Fund.

Commercial Property Tax rates are the same as residential rates. The main differences are that commercial property values are typically higher per square foot, and businesses don’t get homestead and other exemptions that residents get. Due to this, the Commercial Property Tax Rates make up over 1/5 (21%) of the General Fund.

SUMMARY: This was just a brief detail of where the tax money comes from. I hope you find it informative. If you want to gain a deeper understanding of city finances, please know that we always make that available. Visit Castrovilletx.gov/2301/Financial-Documents for access to budgets, audits, and other financial data.

As always, please don’t hesitate to reach out to your elected officials in the city to learn more.

Leave a comment