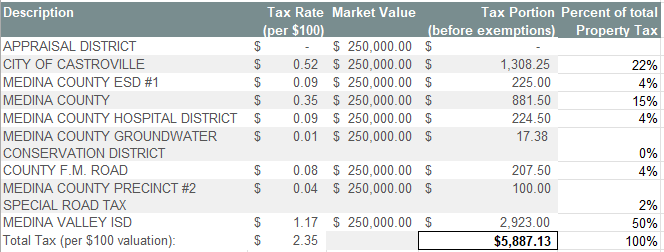

Many people are surprised at how little of their property taxes go to the city. It’s only a little over 1/5 that actually go to all of the services provided in the city. In Castroville, right at 1/2 of the property taxes go to the School District (we should all be happy to invest in the future of our country through the education of our youth today), 22% goes to the city, and 29% goes to the county and county-wide services.

How to read the Appraisal District Tax Rates

If you look up on www.medinacad.org (or www.bexarcad.org for San Antonio), you can see the Property Tax allocation for each taxing entity. The ones I use here are 2022 rates.

For each taxing entity, the rate shown is for every $100 of valuation. I used $250,000 below for consistency. For this price of home, it’s the rate x $2,500 ($250,000 divided by $100).

Property Tax Breakdown (Castroville)

Property Tax Breakdown (West San Antonio)

City-Only Tax Comparisons (So you can compare the actual city taxes for the surrounding cities)

One final Note: Cost of living comparisons can be made from this to a certain extent, but you also have things like insurance rates based on your ISO rating from the fire department. Castroville residents pay much less for property insurance than people in the county. There are many other factors that you can look at for yourself. I hope this gives you some extra tools.

Leave a comment